Where capital city rents are falling further in 2017: Pete Wargent

Pete WargentDecember 17, 2020

Within the Consumer Price Index figures, the ABS produces some very useful quality-adjusted figures on rental price inflation.

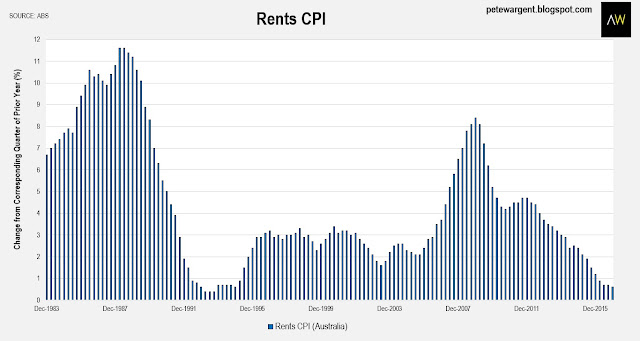

The data series shows how rents can rise very fast when investors are spooked out of the market, such as between 1985 and 1987 (changes to tax legislation) and 2008 (global financial crisis).

When investor activity is high, on the other hand, the growth in rents is likely to be weaker, and this is also the case when low interest rates make buying a home comparatively more attractive than renting.

In this context, nationally annual rental price growth is at its lowest level in more than 22 years, at 0.6 per cent.

In Perth, annual rental growth has turned negative to the tune of -7.2 per cent.

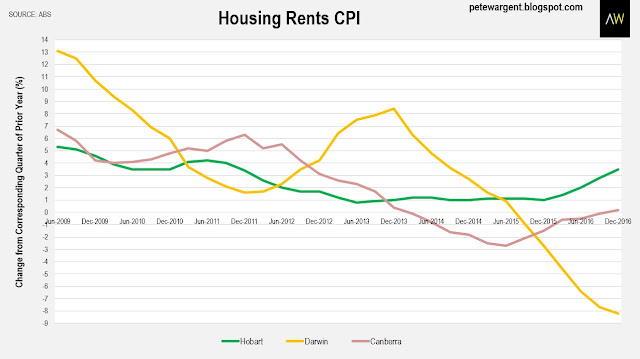

Darwin is by some margin the weakest rental market, with rents declining by -8.2 per cent in 2016.

On the other side of the ledger, Hobart is the tightest capital city rental market, with quality-adjusted rents increasing by 3.5 per cent in 2016.

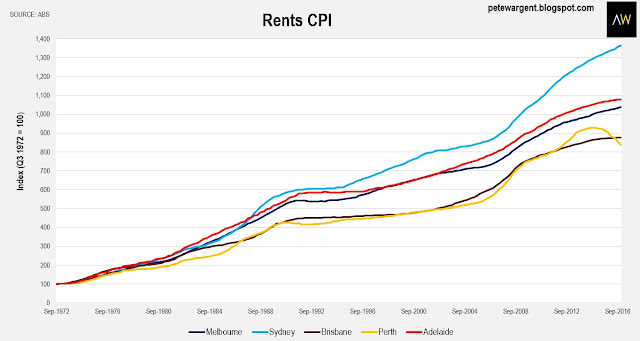

A look at the long-run figures shows that despite the supply response real rents in both Sydney and Melbourne continued to rise to all-time highs.

In real terms, at the city level Brisbane rents are certain to move lower in 2017 due to the inner city apartments overbuild.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.